Note – The article was originally published in 2017 and was revised in June 2022. It has a wealth of information on topics related to bitcoin to help you understand it better.

Bitcoins are the talk of the town, not only the elite investment bankers or the imperious B-school graduates but also Homemakers, local shop owners, and young college kids who know a lot about the mystic cryptocurrency.

The surge from a few 100 dollars to 50000 dollars in a short period and the recent fall have caught the general public’s interest. Some people have made millions, and some have lost.

The falling cryptocurrency prices worldwide are sending shock waves to investors’ spines. Even the most seasoned investors are in double minds, should they hold, buy more, sell, or exit the volatile crypto market.

The media channels and mainstream news publications are interested more in Bitcoins, orphaning the poor farmers, or women rights activists.

The lure of making quick money sitting on a couch in a dungeon hole is a fantasy. Not to mention, how quickly the investment of Bitcoin millionaires was souring is a thing to envy.

Bitcoins are the most explosive and debatable topic.

I read a top shared post back in 2017 on Facebook, it said ” The only advice I would give to my 18-year-old self, seven years back, was to stop wasting the Rs. 500 pocket money and start investing in Bitcoins”.

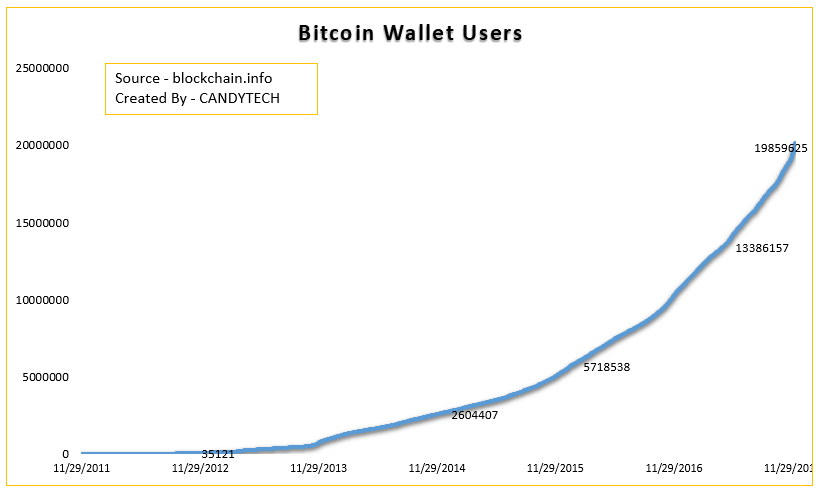

Popular Stats Bitcoins

The enticement is real, tempting, and can make huge money for you, but should you invest?

Let’s find some answers, but if you are not familiar with Bitcoins, here is a detailed article to understand all the basics of Bitcoins.

Bitcoins Origin

Satoshi Nakamoto is an urban legend, the father of Bitcoin, and the person or a group of people who created Bitcoin (an Open Source Software) in 2009.

Satoshi Nakamoto was involved in Bitcoin creation and implementation till December 2010, after which the Bitcoin Core and the network alert key to Gavin Anderson, who later became the authority at the Bitcoin Foundation (is a nonprofit corporation founded in 2012 to promote cryptocurrency usage worldwide).

Besides, as per a report, Satoshi Nakamoto mined 1 million Bitcoins in the early days. You can do the math to calculate the present value of his fortune. It is a bewildering 15 Billion Dollars.

Also, no one knows who Satoshi Nakamoto is, not even the people working online with him on the project in the initial days. The mystery Bitcoin founder has kept his identity secret so far, and there are many theories why he has not come forward.

The theories suggest that the man wants to live without all the media hype and want to keep his fortune safe from the prying eyes of hackers and antisocial elements and the government and the secret service agencies.

What are BitCoins?

Bitcoins is a cryptocurrency and worldwide payment system that allows you to transfer digital payment to any individual having a cryptocurrency account.

Bitcoins are the most disruptive form of digital currency which has challenged the centuries-old banking and payment transfer system.

A notable difference between Bitcoin payment Vs. Digital payments are that Bitcoins are peer-to-peer transactions (from one person to another) while digital currency transfer involves a third party like a bank to work as an intermediary.

Bitcoin is a decentralized digital currency. Also, long before the Bitcoins came into the picture computer scientist Nick Szabo invented a decentralized cryptocurrency in the year 1998, called “Bit Gold.”

Bit Gold is a precursor to Bitcoin technology, and the contribution of Nick Szabo is worth mentioning here.

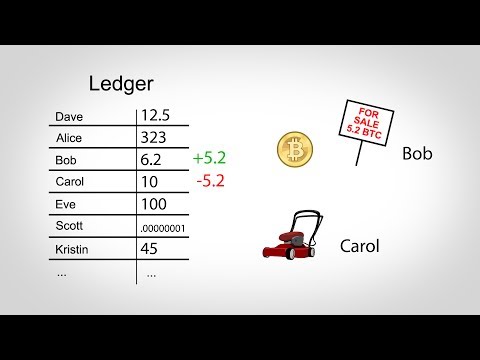

In standard money transfer process, the sender sends money to a third party (a bank or exchange) which then settles the payment with the receiver. In Bitcoins, there is no intermediary. But the transaction is recorded on a publically distributed ledge called “Blockchain.”

Bitcoin Technology

Aforementioned, Bitcoin is a cryptocurrency. In simple words, it means a secured currency using cryptography to handle transactions, create more units and verify the transactions.

It may sound a bit confusing. However, the cryptography uses a technology SHA-2 (Secure Hash Algorithm 2), developed by NSA (National Security Agency).

Notably, the SHA-2 uses a pair of public and private key to authenticate the transactions. Like we use the signature of a cheque to authenticate a transaction. Or even use our MPIN or Password for digital cash transfer.

However, the SHA-2 is far more secure than the traditional signatures.

As mentioned above, all the transactions are stored in the blockchain. It is a ledger that stores the entire details of the transactions.

Bitcoin Mining & Transactions

You may have also come across the term mining, and how graphics cards are used to mine cryptocurrency.

Mining is done to maintain the blockchain. Additionally, to process transactions/create new Bitcoins. A lot of powerful computers are used to solve mathematical functions called as Hash.

Furthermore, the Bitcoin Mining uses a proof of work system, and it is very energy intensive.

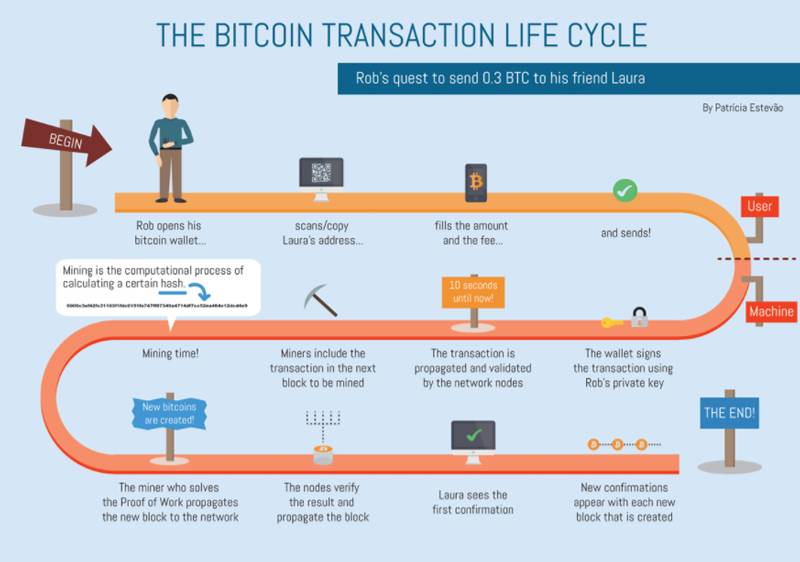

The below diagram shows the complete life cycle of how a transaction is initiated and completed.

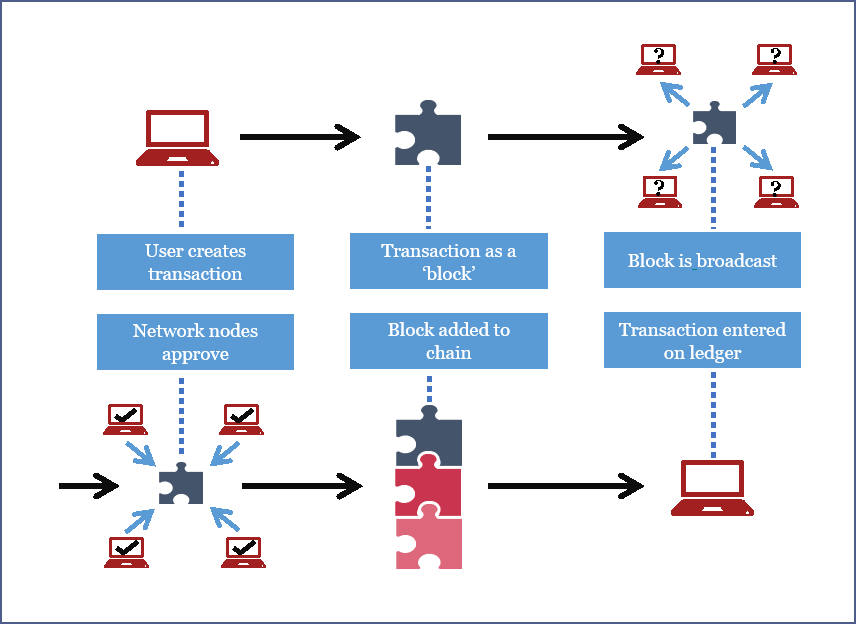

Whenever a new set of transactions need verification and addition to the blockchain. They are bundled in a unique Block. To add this block to the existing blockchain, a mathematical problem must be solved. This is done by miners to provide proof of work.

Also, the below diagram shows how the Bitcoin Transaction takes place using a Block Chain Diagram.

Bitcoin Transactions Diagram

This proof of work requires the miners to find a number called nonce (hash). Notably, this is very difficult to find and uses a powerful computer or a group of computers called as mining pool.

Once the proof of work is found, the new block is added to the chain. Then it is sent to different nodes (miners), who can easily verify this and the blockchain is updated.

The minor who is successful at finding the nonce is rewarded with newly created Bitcoins. He even gets transaction fees.

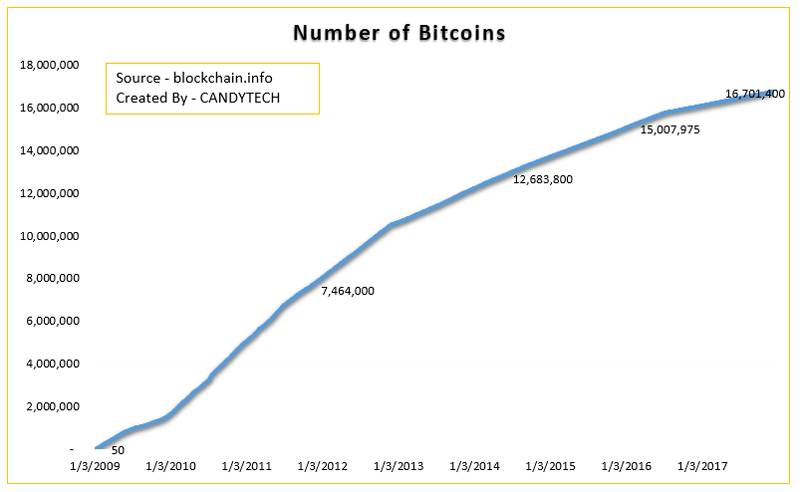

Initially, 50 bitcoins were rewarded to the successful minor, which dropped to 25 in late 2012 and then to 12.5 in the year 2016. It will continue to reduce to 6 and 3 and 1.5 and finally to Zero, and only transactions fees will be given to the minor as a reward.

The reward gets halved after every 210,000 blocks are created. And it will take close to 4 years to create these many blocks. Also, as we know the total number of Bitcoins are limited to 21 Million. The mining rewards will end by the in the year 2140.

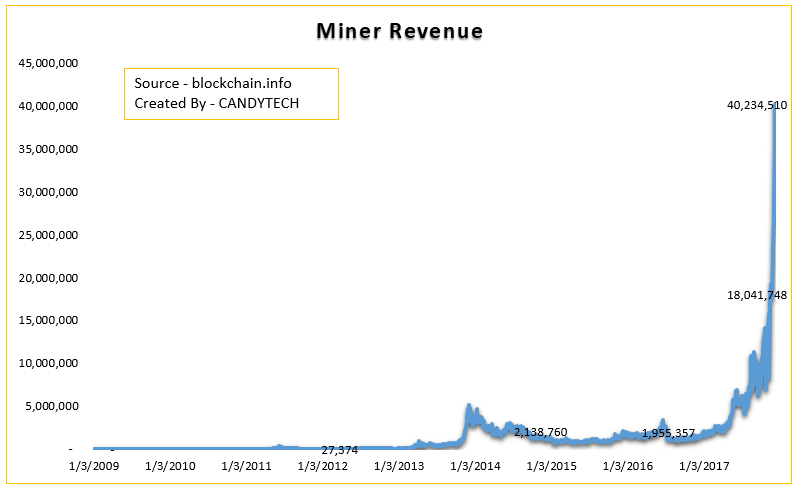

Miners Revenue Trend

So, this is the only way new coins are created and added to the system.

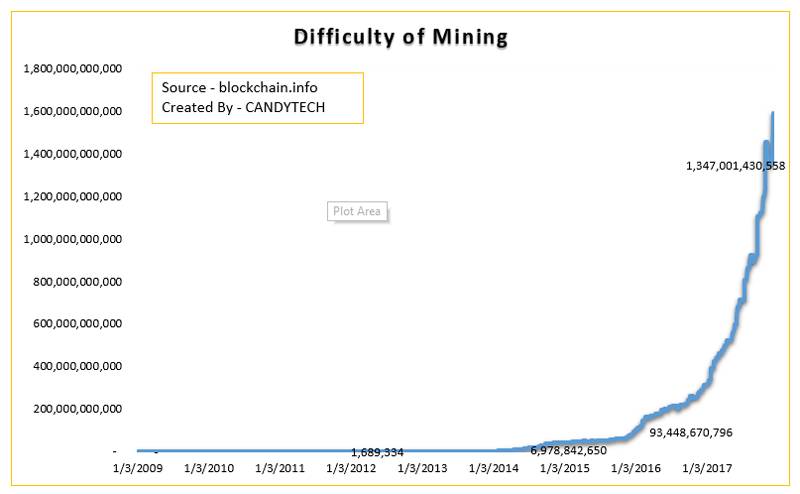

The difficulty of finding hash is adjusted every two weeks. It depends on the number of nodes participating in mining and the hardware prowess of such nodes.

The hash difficulty is increasing with time, and more and more powerful computers are required to mine.

Besides, a mining pool is created by minors where several computers work together to find the hash. Even the reward is split between them based on the work done by each participant.

Bitcoin Core Wallet

Several hardware companies have launched unique motherboards. And miners are using high-end graphics cards and processors to mine the cryptocurrency. Consequently, has increased the demand and price for these parts.

In fact, this has led to an increase in the price of high-end graphics cards. To that end caused pain for the regular PC gamers looking for more computing power to play the latest games.

Energy Concerns With Bitcoin Mining

Aforementioned, a huge number of resources are used to create a blockchain. This is done to find the hash for adding a new block.

The actual productive power used is only from the winning computer. Unfortunately, the rest of the power consumed in the process is a waste.

As per a Citibank report, the mining operation will consume as much power as the whole of Japan in the future and according to a survey done in Oct’17 suggested that the Bitcoin mining consumed 624 Megawatts of power.

It is said that each BitCoin transaction takes about 300KWH of electricity which is sufficient to boil 36000 kettles.

Also, the Guardian reported that the consumption of electricity by the Bitcoin mining operation is more than the energy consumed by the whole of Ireland.

The amount of energy consumed is very high, and the wastage is ridiculous which is even harmful to the climate and is the most significant drawback of this technology.

Bitcoin Units and availability

Bitcoin came into existence when Satoshi Nakomata first published a whitepaper on 31st August 2008. Bitcoin has small denominations. And the smallest Bitcoin unit is called as Satoshi, to honor the founder, and has a value of 0.00000001 Bitcoin.

A millibitcoin is 0.001 bitcoin. So you don’t need to buy a Bitcoin that is currently available for $15000 or Rs. 1,000,000.

Further, Bitcoin availability is limited to a maximum of 21 Million Coins. Out of that, about 1 million coins are with Satoshi Nakomata.

Noticeably, Bitcoins can be lost. If the person holding the private key to the Bitcoin wallet loses the key. Bitcoins can be locked forever and will be out of circulation.

There have been incidences of people losing their private keys and also losing the bitcoins forever. You need to keep 1-2 more backups of the private key in a pen drive or SSD to keep it secure for years.

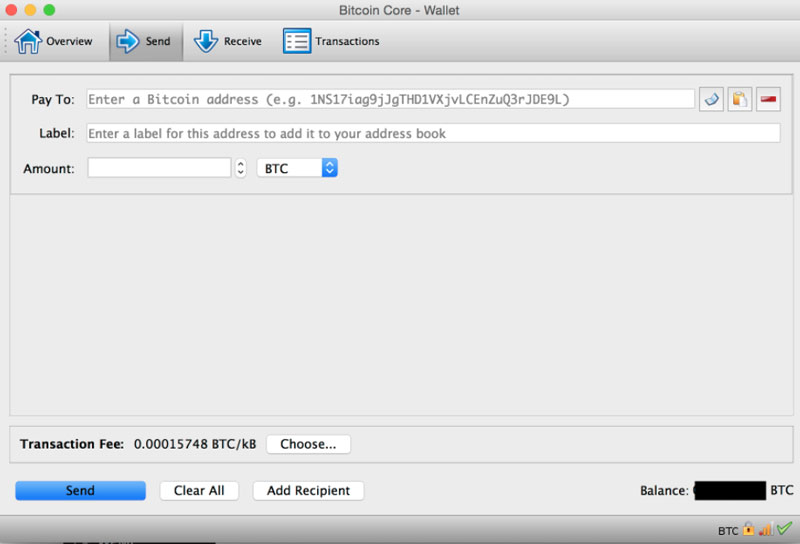

What is a Bitcoin Wallet?

A bitcoin wallet stores your public and the private key to transact and has a record of how many Bitcoins you own.

Lightweight Client Apps are available which can help you transact in the bitcoins without a need for having the entire blockchain on your machine.

Notably, the size of complete Blockchain is incredibly large – 136 GB. Minors download and keep this data. Nevertheless, most people just use the lightweight clients to transact.

Frauds and Hacking in Bitcoin World

As per research, by Carnegie Mellon University (CMU) up to 9% of the transactions in 2012 were used for shady deals. These were used for drug trade, weapons purchase, child pornography, etc.

Furthermore, people think Bitcoins are safe due to their cryptography. But there are incidents of hackers stealing a fortune from individuals, and currency traders. Many people see this as a security risk.

In the past, malware attacks were used to steal the private key stored on the local computers. Then hackers steal Bitcoins using the key. Notably, in 2014 Bitcoins worth @220,000 were stolen by using a botnet-based virus.

Unauthorized mining is another critical issue for Bitcoins. Hackers have used other’s computers for Bitcoin mining without the computer owners’ knowledge. Besides, hackers use many remote PCs and servers for mining work.

Additionally, in December 2013, the German police arrested 2 people accused of mining close to 1 Million dollars worth of Bitcoins. They used others computers with customized botnet software running in the background. They did it without the knowledge of the owners.

So, you may want to look deeper the next time you see your PC usage going bonkers for no reason.

Also, in November 2013, about 100 Million Dollars of Bitcoins were stolen from illicit goods online market called Sheep Market Place.

The theft led to the closure of the company in December 2013. And later, one person was arrested by Czech police, who bought an expensive house and paid fully in Bitcoins. It was estimated to have a value exceeding $800,000.

However, the most significant hack was when the Japanese Bitcoin exchange Mt Gox lost 850,000 Bitcoins which led to the closure of Mt Gox in 2014. Based on the current value of the Bitcoins, they were worth a staggering sum of $12.7 Billion.

Biggest Bitcoin Fraud

Later on, about 200,000 bitcoins were recovered but the company that was a leading exchange handling 70% of the Bitcoin trade worldwide, filed for bankruptcy and closed down operations in 2014.

As reported in 2017, a cryptocurrency mining company Nicehash lost 4700 Bitcoins (worth more than 70 million dollars). The company shared the news on their Facebook page and stated that this was a professional attack and they are investigating how it happened.

Bitcoin Acceptance By Merchants and Refusal by Steam

Typically merchants charge credit card processing fees of 2-3%. However, in the case of Bitcoins, the fees for accepting payment are less than 2%.

A lot of companies like Microsoft, Dell, NewEgg, and Paypal accept payment using Bitcoins also, you can quickly transfer the payments to any of your client or supplier who accepts payment using Bitcoins.

One key advantage of peer to peer payment is that you may not need to disclose the amount to the government and can even bypass the GST (tax) as the government has no way of finding out about these payments.

Currently, Bitcoins have limited use and acceptance. Contrastingly, there have been cases when companies have stopped accepting Bitcoins. Like the recent episode, the famous Gaming service, Steam stopped accepting Bitcoin payments.

Steam Stops Accepting Bitcoins

For starters, Steam is a popular platform for purchasing games. And earlier, they were accepting payments with Bitcoins. But the recent volatility in the Bitcoin has led them to stop allowing such transactions.

Moreover, Steam says in a statement that there is insane volatility in the Bitcoin value. The value of Bitcoin changes drastically between the time a transaction start and ends. This leads to either overpayment or underpayment by the buyer.

Furthermore, balance settlement requires a secondary transaction. This is a big headache for Steam.

How to Invest in Bitcoins in India

So, how to start investing in Bitcoins in India? There are several Bitcoin exchanges that allow you to purchase bitcoins online like Zebpay, Unocoin, Coinsecure, Coinmania, and Localbitcoins, etc.

Also, several local exchanges accept cash and create a wallet for you. They will even take documents like Aadhar and Pan cards to set up an account. In case you don’t want to go the online route.

I recently spoke to one such exchange owner who is running it in Delhi, and he shared with me the business is booming and with the recent surge in the Bitcoin price and media popularity lot of retail investors want to try their luck in this business.

How to Start an Online Bitcoin Account

You can go to any website I have mentioned above, for understanding purposes let’s say we use the Zebpay.

- 1. You can download the Android or iOS App from the respective store and start with the verification process.

2. You will need to provide your mobile number, Aadhar card, pan card, and bank details to finish the verification process.

3. You will also need to upload the pan card, Aadhar card, and a canceled cheque.

4. It takes 2-3 days to get the account verified.

5. Next, you need to transfer funds from your bank account to the Zebpay RS account. - 6. It can take 2-3 hours for the funds to reflect in your account after the transaction.

7. From the home screen, you can initiate an order of Bitcoin by inputting the amount in Rs which you want to invest.

8. The App will ask you to enter your four-digit transaction pin, provided to your after the registration process. (You can purchase Bitcoins for as little as Rs 1000).

9. Once you enter the pin and accept the transaction. You will get the equivalent amount of Bitcoins.

10. Congrats now you have become a Bitcoin investor.

Who are the Major Investors in Bitcoins?

The bitcoin transactions are anonymous, but each transaction comes with a coded address. The transactions help to track significant investors, but their exact details are unknown. Aforementioned, the founder of Bitcoin, Satoshi Nakamoto, has 1 Million Bitcoins, estimated to be worth 15 Billion dollars.

As per a Bloomberg article, the top 100 investors control an astonishing 17.3% of the total Bitcoins.

The Winklevoss Twins (from whom Mark Zuckerberg stole the idea of FaceBook) invested about 11 million dollars in Bitcoins in 2013 and owns about 1% of Bitcoins in the world, worth more than a Billion Dollars based on current valuation.

Bitcoin Futures Trading

On 10th December 2017, the CBOE (Chicago Board Options Exchange) has allowed investors to take bets on the Bitcoin futures. The price for Bitcoins increased by almost 10% to a peak of $18,700 and then settled at $17,800.

The CBOE website almost crashed with the volume of traffic. Besides, The circuit breakers suspended the future trade twice due to the excessive volatility in the Bitcoin value. However, some investors see Bitcoin’s Future trading as a positive step. Also, the listing on a regulated exchange makes Bitcoin more mainstream. But at the same time, there is more opportunity for speculators to gamble on this volatile digital currency.

Is Bitcoin a Bubble: What Experts Say About Bitcoins

Many authorities have labeled Bitcoin a speculative Bubble; Fed Chairman Alan Greenspan and economist John Quiggin are a few people who have criticized Bitcoins as purely speculative instruments.

Robert James Shiller, a noble prize winner and economist, said that Bitcoin “exhibits many characteristics of a speculative Bubble.”

Also, there is an ongoing debate if Satoshi Nakamoto will start selling Bitcoins in the market. This can lead to the crash of this speculative bubble. But others believe that it will not happen as he knows well that the cryptocurrency value will surge.

On 14 March 2014, Warren Buffet ( one of the world’s greatest Investors said: “Stay Away from Bitcoins, it is a mirage.”

What is RBI saying about Bitcoins?

Indian Reserve bank, on 5th December 2017 has, also cautioned Investors to stay away from Bitcoins and warned about the risks of investing in any form of cryptocurrency. RBI says that cryptocurrency has risk for operational, economic, legal, and customer protection.

RBI has also said that they have not given any special license to any company for running a trading license in India or operating in such schemes.

Historical Investment Bubbles

Investors have lost huge sums of money in previous such schemes. In comparison to Bitcoins, they have some similarities. Ars Technica spoke to two experts in the field from the University of Maryland and MIT, Brent Goldfarb a business professor, and William Deringer a historian.

Both the professors have researched in the field of financial bubbles and said that they see similar trends with the Bitcoin. The previous investment bubbles like the Great Briton Railroads in 1840 or the internet companies bubble in the 1990s have similar characteristics.

They have also drawn an analogy to the Tulips Mania, which happened in Europe in 1630. Tulips were a rarity in Europe back then. And sellers imported them from the middle east.

There was a demand for colorful and beautiful tulips in Europe, which shot up the prices by 20-fold in late 1636 and, after a couple of months, crashed to an average level.

Back then, sellers crossbred Tulip seeds to develop new colored tulips. It brought a lot of excitement, as no one was sure about the final flower colors when sowing the seeds. The added mystery enticed the investors and also created the hype.

People are not only buying Bitcoins for the currency’s economic value, but it also brings a lot of coolness factors. It is a bold statement that tells who you are, and how aware and futuristic you are compared to your peers. In the same way, the beautiful Tulips made people feel superior in the 1600 century.

Is Bitcoin a Good Investment opportunity

So even after reading a lot about Bitcoin still leaves some doubts about the technology or how the Bitcoins work, you are not alone.

The underlying technology is cutting edge, and if you are new, it will take some more thorough reading to understand some of the concepts.

But do you need to understand every part of Bitcoin technology to become an investor, the answer is No.

As a lot of people use the internet every day, but they don’t understand the underlying technology. How does the internet work? How do developers create web pages? What is the role of Java, CSS, HTML or the web server in serving the internet pages?

In the same way it may be difficult for everyone to understand Bitcoin technology in-depth, but I will suggest you do a lot of reading, watch videos before even thinking about investing in Bitcoins.

Also, there are lots of misleading Ads which promise you quick money by investing in Bitcoins, humble advice, just stay away from them.

I am not a financial advisor to tell you whether you should invest in Bitcoin currently or wait for a market correction.

You will find rare advice from prudent investors to put money in Bitcoin. Mark Cuban, the billionaire investor, said that you could invest upto 10% of your saving in Bitcoin, though you should be prepared to risk your investment for the gains.

Bitcoin is a new phenomenon, and some believers think the value of Bitcoins will rise exponentially with time. Others believe it is a bubble like the tulips bubble or the technology stocks bubble, which can burst anytime.

The thing is, Bitcoin Boom is real, and the lure to make money in Bitcoins is real too, but can you risk your hard-earned money?

Bitcoins Explained in Videos

Mystery Founder of Bitcoin

What is Bitcoin by Bitcoin.org – Video

Bitcoin Transactions Explained Technical

How the Blockchain is Changing Money and Business – TED Talk

Additional Resources

You can check some latest Stats on Bitcoins on Bitcoin Info. Also, can read more on Bitcoins on Wikipedia. Also, share your thoughts in the comments below or your experience if you have invested in Bitcoins.