On a Friday afternoon, I was very close to getting scammed by a sneaky digital thief. He almost fooled me. Let me share with you my experience and how you can stay safe from digital fraud.

I am one of the most aware and cautious people when it comes to using digital payments.

Nearly 90% of the money I spend every month is through credit cards, PayPal, PayTm, Google Pay, and other net banking and UPI transactions.

There are payments done in India, P2P, business, and even international payments. I guess you get the picture.

OLX PayTm Google Pay Scam – How it Works

Don’t Get Scammed (UPI Frauds) on OLX, PayTm, Google Pay

Like everyone else, I get several scam messages, emails, and calls to share the bank details, but they are easily identifiable. But this was different, clever and meticulously planned.

So I was just busy writing an article on Friday noon when I got a call from Mr. Vikas Kumar on my mobile. I have a true caller, but there was not much information that flashed on the screen. So I picked up the call.

The fellow at the other end asked me if I have posted an AD on the OLX for selling a TVS mechanical keyboard. He pronounced my name wrong and told me he wants to buy the keyboard for his young brother who is studying in a college.

Then he started to negotiate the price, and we settled for Rs. 1300. Further, he told me that his brother would come and pick up the keyboard from my address and enquired about the address and landmarks.

So far, everything looked normal, and he behaved as a genuine buyer would. Then he asked me if can take payment using Google Pay or PayTm. I told him it is just 1300 bucks, and his brother can come and see the keyboard and pay it cash.

He told me that his brother may not have the cash right now, so he will transfer the money, and then his brother will come to pick up the keyboard. Like everyone else, when you are keen to sell something, you may overlook some tiny details. I was on call for almost 5 minutes, my son was playing near me, TV was on, and half of the brain was busy tracking the Vodafone-Idea stock price.

It was not a big deal, so I said okay you could send the money on PayTm, and I will give the keyboard to your brother.

So, here is what I can make out from his voice. He was in his 20s, not very educated but enough to know about online payments, his accent has a touch of Bihar or UP.

He then asked about my Paytm account connected to UPI and bank, on which I told him it doesn’t matter; you can send money to this number.

He told me that he would send Rs. Five first, and then once it happens, he will do the second transaction to transfer the remaining amount.

He asked me to open the Paytm App, and I confirm the transaction. I rarely do P2P transactions on Paytm, so it was something new. But I immediately spotted that the transaction was to debit from my account instead of credit.

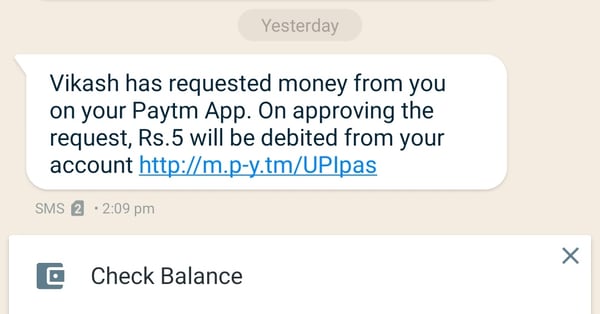

Here is the message I got; I think a lot of people may fall for it.

Fake Messages Asking For Payment Approval

If I had approved it, he would have asked for accepting the second transaction and could have easily siphoned the money.

I told him, “I understand what you are trying to do, idiot. I am going to share your number with cyber-crime cell and Paytm support as well.”

He just got pissed and said a few saintly words to me and hung up.

I think a lot of people would be falling for such scams, and in this case, the caller was a pro. He was doing this may be the 100th time, and when you do something too many times, you get better and better.

I reported the incident to Paytm on Twitter, and they have not done anything so far, not even replied.

Prevent UPI and Payment Frauds on Paytm, Google Pay

Digital payments are convenient, but considering the general population’s experience and training about the risks and frauds in digital transactions, these can cause financial loss.

A lot of people fall for such theatrics; even the new Netflix serial Jamatra throughs light on the growing menace of banking and digital frauds in India.

A lot of people are losing hard-earned money, but I think organizations like Paytm, Google Pay, Banks, Phone-Pe, and similar wallets need to have more in-built fraud prevention measures.

There are some measures like setting a limit on the daily amount of transactions, the number of transactions, and maximum transfer limits on credit cards and wallets. But they are never emphasized by these companies.

Everyone is busy selling and making more money. No one is educating the new users in the system who can become sitting ducks for these scammers.

There is a lot more effort required on behalf of these organizations to keep the end-users protected and safe.