Let’s Check out India’s latest smartphone market share report for top brands (Samsung, Xiaomi, Oneplus, Apple, Oppo, Vivo, Realme) in India for Q2 2022 (Apr-May-Jun).

The total smartphone shipments were close to 37 Million in Q2-2022, a decline of 5% in comparison to Q1-2021(Jan to Mar).

About 29% of the smartphones (10.73 Mn) shipped in Q2 were 5G.

Further, the smartphone average selling price has increased by about 10% and 22% of users have bought phones over Rs. 20,000.

Top Smartphone Brands in India – Market Share (Q2-2022):

| Smartphone Brand | Market Share in India (2022) |

| 1. Xiaomi | 19% |

| 2. Samsung | 19% |

| 3. Vivo | 17% |

| 4. Realme | 16% |

| 5. Oppo | 11% |

| 6. Apple | 3.35% (approx) |

| 7. Oneplus | 3.0% (approx) |

| 8. Others | 11.65% |

*Others (LG, Huawei, Asus, Google, iQOO, Lenovo, Motorola, Tecno, Infinix, Micromax, Lava, ITEL, etc.) – Market Share – 11.65%.

Top Brands Smartphone Market Share in India

1. Xiaomi is the number 1 brand in the Indian mobile market with a 19% market share.

2. Samsung is a close second with a similar 19% Market Share.

3. Vivo is the number 3 brand in the Indian market, with a 17% share.

4. Realme is in the 4th spot with a 16% share.

5. Oppo is in the 5th position – 9%.

6. Apple has a 3.35% share in the mobile market.

7. Oneplus – 3.0%.

Xiaomi is holding the lead at the front, while other Chinese players like Oppo, Vivo, and Realme are doing great in the market. Samsung has shown remarkable pullback in recent quarters and gained market share. Xiaomi’s share has declined from 28% in Q2-2021 to just 19% in Q1-2021.

Chinese Mobile Companies Market Share in India

Chinese smartphone brands – Xiaomi, Oppo, Vivo, Realme, Oneplus, iQOO, and Transitions Holding have close to 70% market share in India.

While the rest of the market share is taken by Samsung, Apple, Nokia, Google, and others.

Indian Mobile Brands Market Share – Micromax and Lava

Indian mobile brands have a negligible market share. Micromax has less than 1% market share, and Lava has an even lower share in the fiercely competitive mobile market.

Smartphone Market Share India Change Q2 (2021) Vs. Q2 (2022)

| Mobile Brand | 2021-Q2 | 2022 -Q2 | % Change |

| Xiaomi | 28% | 19% | -9% |

| Samsung | 18% | 19% | 1% |

| Vivo | 15% | 17% | 2% |

| Oppo | 11% | 11% | 0% |

| Realme | 15% | 16% | 1% |

| Others | 13% | 18% | 5% |

- Xiaomi has declined in market share by 9% in the last 1 year.

- Samsung has increased it’s market share by 1% in last year.

- Vivo and Realme has gained market share while Oppo is able to maintain sales volumes.

- Share of Others has increased significantly in the last quarter, and Apple is one of the biggest gainers in the premium segment in the Indian market.

- Other brands, including Apple, Oneplus, Lenovo, Motorola, iQoo, LG, Google, and Asus, individually have less than 5% market share in India.

The top 5 brands have a 82% market share in India, and all the remaining brands collectively have just 24%.

The below data is based on the counterpoint research… we have not considered IDC or other research numbers.

OnePlus and Apple Market Share in India (Estimated)

Apple has a close to 4% market share in India, and OnePlus has about a 3% share in the overall Indian market. Oneplus market share in India is growing as the brand has started to sell affordable smartphones in the sub-30k price range.

Premium Smartphone Market Share (MS) – OnePlus Vs. Apple Vs. Samsung (Q3-2021)

In the premium mobile segment (Greater than Rs. 30,000 or $450). Apple has close to 44% market share in Q3-2021. Samsung has a 25% market share, whereas Oneplus has 14% MS, and others have 18%.

Collectively all three brands are put together to have an 84% share of the market. The rest of the players like Google, Oppo, Asus, Xiaomi, and Vivo accounted for 20%.

Apple has a strong presence in the market, and thanks to the price cut for iPhone 12, and 13 series, the brand has done exceptionally well in the Indian market.

Many premium buyers are moving to Apple from Android due to better hardware, software experience, and future updates.

The top-selling phones in the premium segment are the iPhone 13, iPhone 12, Oneplus 9 series, Oneplus 10 Pro, Nord 2, Samsung Galaxy Note 20, and the S22/S21 Series.

Notably, Vivo has launched the new brand iQOO to improve the market share in the premium segment, and the new X80, X70 series are also selling well. Oppo is also doing excellent with the new Reno 8 and 8 Pro.

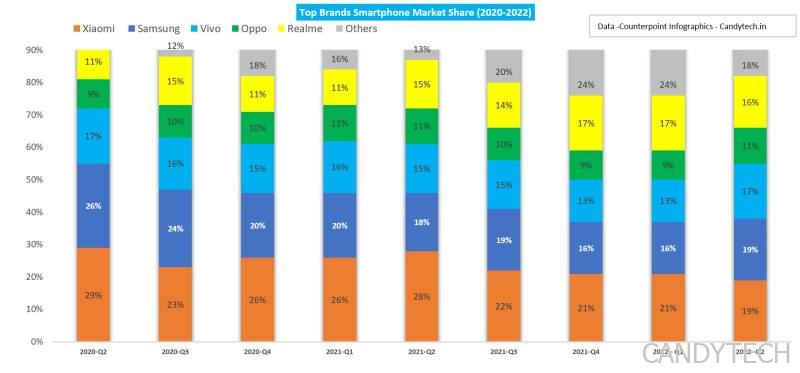

Long Term Smartphone Market Share Trend in India (2020 – 2022)

Also, Read:

*LENOVO includes Lenovo and Motorola shipments.

Indian Mobile Market – Size, Volume, and Facts

More than 10 million 5G smartphones were shipped in Q3-2021, and most manufacturers offer 5G mobiles above Rs. 20,000 price segment.

In 2021, smartphone shipments reached 169 million, an 11% increase over the last year. Apple had close to 5.5 million shipments in 2021, and the iPhone maker had a market share of 3.35% in 2021.

India is the second-largest mobile market, ahead of the US, with over 400 million smartphone users, whereas China leads in terms of the number of users. About 55% of smartphone sales are online in India, whereas retail accounts for a 45% share.

There were close to 52 Million units shipped in Q3-2021. In contrast, about 38 Million smartphone shipments were made in Q1 2021.

About 33% of phones sold are in Rs. 11,000 to Rs. 18,000 price range and is the fastest-growing segment.